I don't know this strategy in detail. But, in a quick test I did, I didn't understand until when my BTC would be available, with this strategy. So I think it would be really interesting to have a timeline on this information.

I agree that there might be some easier or better ways to describe what is being attempted with this kind of tool, which means how any of us might attempt to put it into use for ourselves and in accordance with our circumstances (such as the size of our BTC stash or a part of our stash) and if we feel that we are getting to the stage that we would like to begin some kind of a regular and hopefully sustainable withdrawal depending on how aggressive that we might be in our withdrawal system. Another thing is that maybe you have a bitcoin stash of 100, but you want to put 21 BTC into a business or a trust, and then tell them that their budget is based on the sustainable withdrawal system, and maybe you even tell them what withdrawal rate to use, and if you might be beginning with such process, you might choose a lower percentage, so that you get used to the idea of withdrawing, but you are withdrawing in such a conservative way that in a longer term basis you are not tending to lessen your BTC value, especially if you are measuring it in terms of the 200-week moving average rather than the spot price. Of course, when you withdraw, you will get the spot price for the BTC that you sell, so there is a presumption that you are actually cashing out the BTC or using the BTC for some kind of a purchase of a good or service.

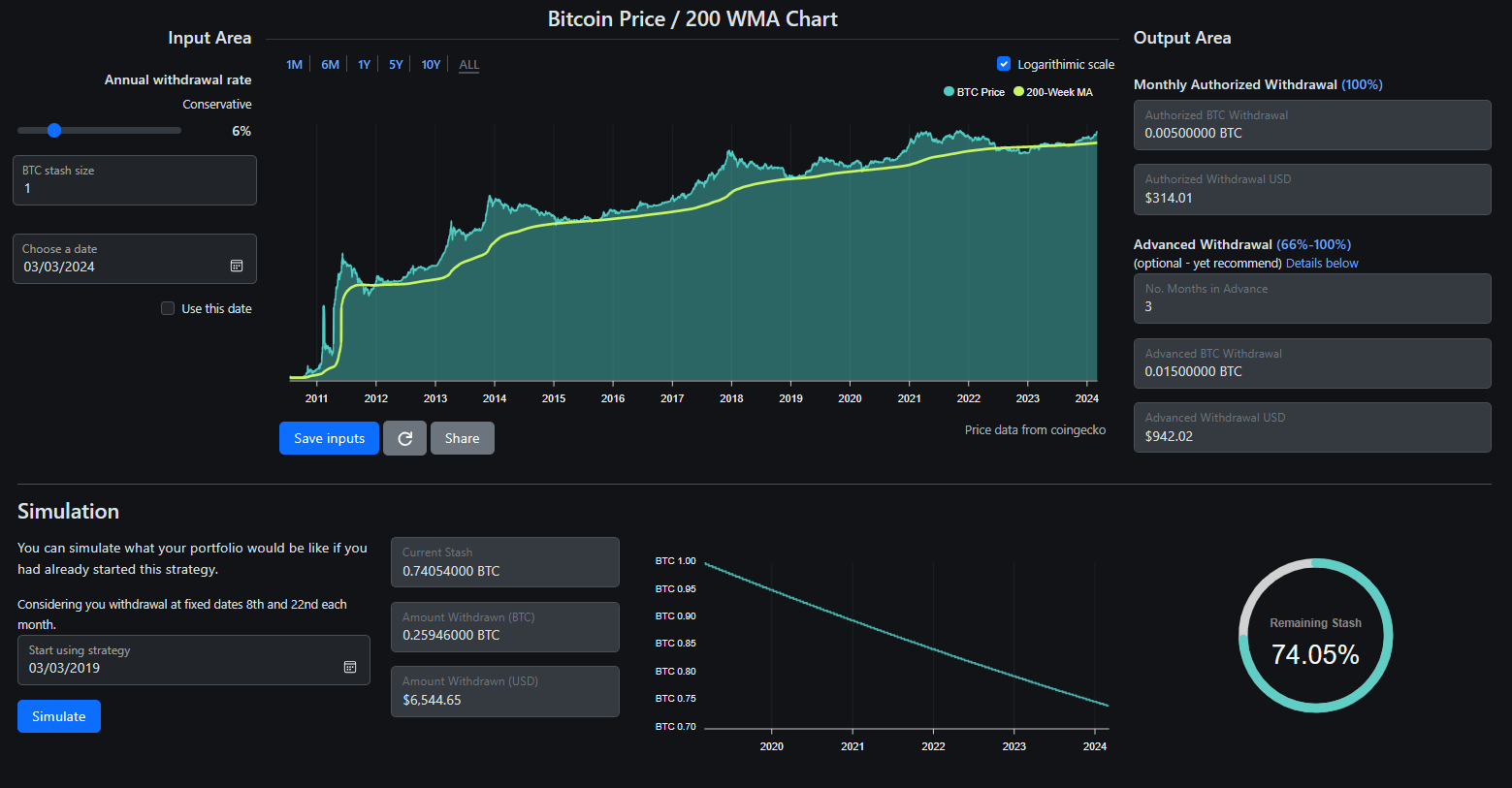

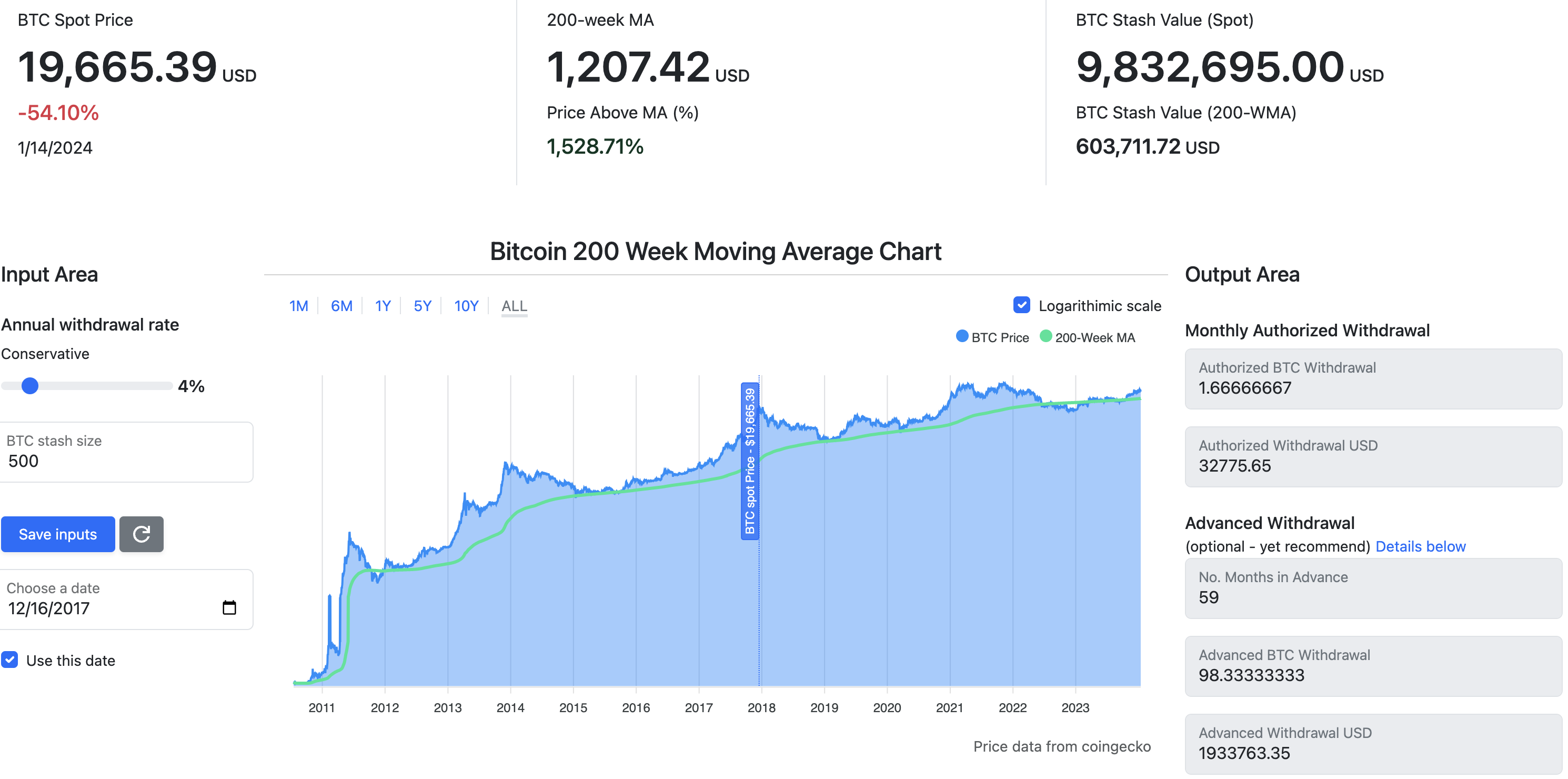

Well, I am going to try to stick with the 21 BTC as an example that I gave in my thread, and I showed more than a year of withdrawal and ONLY 0.5 BTC had been withdrawn, and those withdrawal amounts were generally on the conservative side... and still getting used to the system, yet at the same time, the BTC price spent a lot of time below the 200-week moving average, so the withdrawal amounts were reduced during that period of time, so if you look at the explanation on the site, the BTC spot price needs to be at least 25% the spot price before you are allowed to withdraw the full monthly allotment (based on whatever percent that you had already established, and my earlier examples used 4%, since that is quite a conservative percentage and lines up with traditional ideas of withdrawing asset, such as in retirement income purposes).

So if the BTC spot price is less than 25% above the 200-WMA, there are various gradients of reduction of the amount that is authorized for withdrawal.

If you look at the above selection of 20.5BTC at 4% withdrawal rate, you will see that currently, the spot price of that 20.5 BTC is 41.93% higher than the 200-week moving average, which makes the whole portfolio worth $877,072 in terms of its spot price as compare to its 200-wma value at only $617,975.24, so for this month, there is an ability to withdraw up to 0.6833333 BTC which has a BTC spot price value of $2,923.57 if you cash it out right away. You can also cash out up to 1 month in advance, but then you won't be able to cash out the next month, unless the BTC price is at least to a level that authorizes additional months. To me it seems that the most important number is the number of BTC that you can withdraw, and if the BTC price is changing throughout the month, then maybe it is less confusing to withdraw all at once for the month.

You have the ability to define the beginning and end of the month however you like whether it starts on the 1st of the month or the 15th, and then whether you decide to withdrawal in a lump sum or 1/4th of the authorized amount weekly for 4 weeks.. which is not quite a month.. but according to this tool, a month is 1/12th of a year, even if there are different numbers of days in each month.

If you withdraw advance months, then you need to keep track of that. Let's say that I decide to structure this tools so that my months begin on the 10th of each month, so the 10th would be the earliest that I could withdraw for January, and if I decide to withdraw for January and for February, then I would not be able to withdraw again until March 10 at the earliest, unless the BTC price passes above some other threshold that authorizes the withdrawal of additional months.

Just because you can withdraw the max does not necessarily mean that you have to withdraw the max, especially if the BTC price is close to or even below the 200-week moving average, but if the BTC spot price goes to more than 14x higher than the 200-week moving average you may well be incentivized to take advantage of withdrawing the additional 59 months because the spot price is so high, and if you had already withdrawn some of the additional months at earlier stages, then it is upon you to keep track of how many months in advance that you had already withdrawn in order to figure out how many you still have remaining in your authorization, so if you had withdrawn 35 months in advance after the BTC price went 650% higher than the 200-week moving average, and then 1 month later the BTC price goes up 14x higher than the 200-week moving average, you could withdraw 24 or 25 extra months whether you had moved into a new month, and if you had not moved into a new month, you would only be able to withdraw 24 additional months in the 14x higher range (that is 59-35).

Maybe another example is in order.

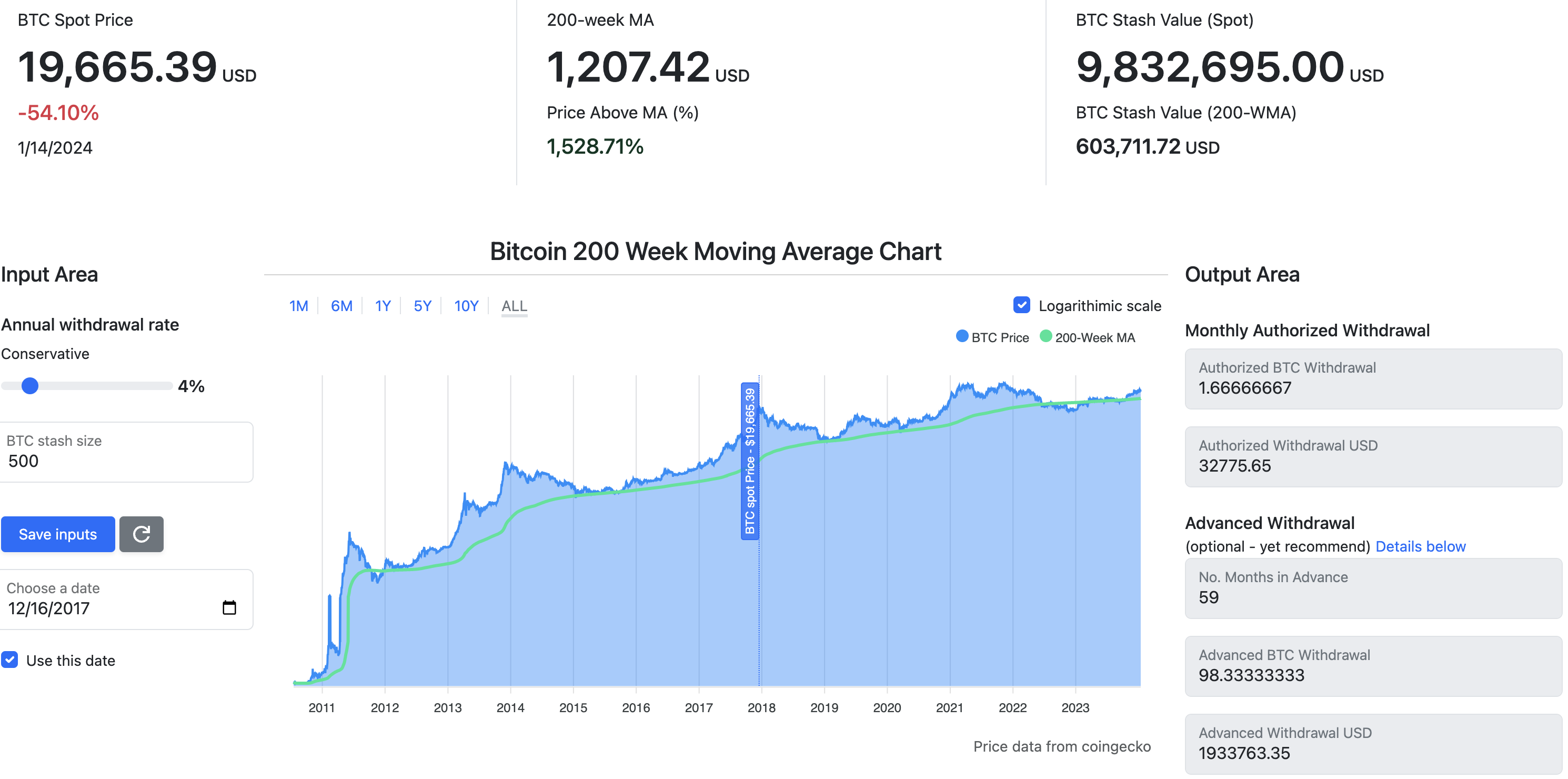

If you had been using this same system on December 16, 2017, then maybe you might have needed to have 500 BTC in order to have a similar amount of 200-week moving average value as is the 20.5 BTC today, and at that point, BTC spot price was more than 15x higher than the 200-WMA, and your 200-WMA value would have been around $604k but your BTC spot price value would have been close to $10 million..

With a 4% withdrawal rate, the tool would have allowed you to withdraw 1.66666667 BTC per month and 59 months advanced, which would have had been 98.333333 BTC. Of course, if you had already withdrawn some advanced BTC, you would only be authorized to withdraw the amount of BTC that you had remaining from the 59 advanced months and/or the then current month.

Another interesting approach would be to indicate the USD value that the user wanted to withdraw. This allows you to get an idea of how long the value in your portfolio would last.

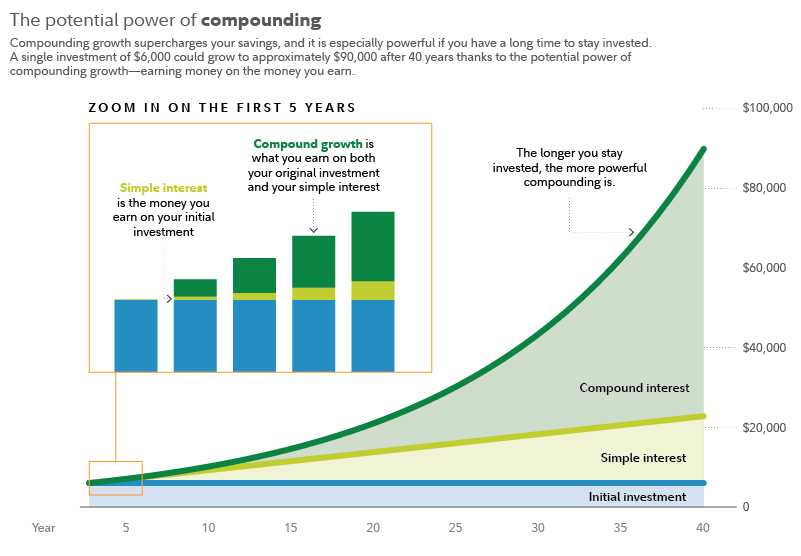

Each month, you are ONLY allowed to withdraw the BTC that is authorized for that month, so you should be measuring how much BTC to withdraw, and of course it has a dollar value that day that is changing on a regular basis, but the 200-week moving average does not change as much as the spot price. And, you should able to continue to withdrawal in this kind of way in perpetuity (which is another way of saying sustainable) as long as BTC continues to perform at least as high as your withdrawal rate (which means that as long as the BTC increases in its dollar value on average at least at the rate that you are withdrawing). Yeah your BTC amount will continue to go down but its dollar value would continue to go up at least at the rate that you are withdrawing, and if you are withdrawing more than the rate it goes up then the system would not be sustainable, but this system presumes sustainability based on fundamental analysis and various BTC price performance theories, including that you can look at

my projection of the entry-level fuck you status chart, and if you believe that BTC future price projections should be more conservative than the ones that I indicated there (which seem somewhat conservative already), then you can reduce your withdrawal rate in accordance with your own beliefs in order to feel more comfortable with your own view regarding how much of a BTC withdrawal rater that you believe to be sustainable..

Another point that I noticed, although the price chart is possible to apply several temporal filters, I found it a little unnecessary (and perhaps confusing), since the strategy is about the last 200 days. So the graph should only show data from the last 200 days.

It is a 200-week moving average not the 200-day moving average. 200 weeks is about 4 years, and 200 days is about 2/3rds of a year.

Part of the reason to have the history is to see how the spot price has moved in reference to the 200-week moving average, and to see that the 200-week moving average tends to be a bottom, except the recent 16 months (between about June 2022 and October 2023) the 200-week MA was not as much of a complete bottom indicator, but still we stick with the theory of 200-week moving average mostly being a bottom price because it mostly holds up.

This tool is also not for trading.. which might be something that the 200-day moving average might be used for.

Here are my first impressions. I will keep an eye on the project. Thank you for your work.

We may well need to continue to figure out better ways to present this information.. or to clarify certain parts a bit better so it might start to seem more obvious regarding how to try to use the tool in ways that will be helpful to each of those wanting to use the tool.

Very good, can I make a suggestion?

put something like this, but referring to the past. For example.

If I had used this strategy from 2016 to 2020, how much return would it give? How much could I withdraw? It would be very interesting for those who are not used to this type of investment to see what profitability they would have lost if they had followed this strategy.

Other than that, very good and congratulations to everyone involved.

It could be possible that we could give an example that would show someone starting with a certain BTC stash in 2016, and then ending with a smaller amount of BTC in 2020.

My Hypomyth chart does something like that in order to project ahead.

Of course, above in my response to joker_josue I already mentioned that in terms of its dollar value, a budget of 20.5 BTC today is similar to a budget of 500 BTC in 2017, so the stash for 2016 would be even higher to be the equivalent of my 20.5 BTC example of today, and of course

various posts in my thread also shows how the hypothetical had started out at 21 BTC in late 2022, and currently has been reduced by 0.5 BTC due to monthly withdrawals.

I love the concept and the idea, it is very detailed however I expect to see a more robust scope of coverage in time to come. It might start as a narrowly focused concept or idea but will expand in a short while.

If you know how to use the tool in terms of trying to make quick comparisons of how the 200-weekMA and the spot price have differed historically or even at any particular time (such as today right now as the price moves), the tool already provides a lot of information that would be otherwise difficult to figure out in such a rapid way and especially incorporating your own specifics into such a tool, that is if you know what the tool is showing.

It could be the case that some of the information in the input area versus the output could be presented with some better clarity and some better explanations, but if you figure out a budget that you have (whether that is a budget of 20.5 BTC or some other amount) and if you figure out your withdrawal rate (whether you are going to use 4% or some other rate), then you can get some quick answers to your questions, including if you change the dates or if you quickly change some of the amounts that you would like to use.

From the wealth of experiences you hav egarnered over the years, i expect to see them playout even as the trust in the community gets directed to your project.

I think that

my entry-level fuck you status chart shows how bitcoin-bottom prices has performed over time, and if we believe that we have accumulated enough BTC, then we can start some kind of withdrawal of them on a regular basis... It may well not be a good idea to start any withdrawal system until reaching a certain quantity of BTC in which it starts to seem practical to move from the accumulation stage to the maintenance stage and then to the liquidation stage, and if you are still accumulating BTC and not quite sure which stage that you are in, then you might not have enough BTC to feel comfortable using the tool - especially since this is not meant to be a trading tool.. except to the extent that any of us could use this kind of tool to manage our BTC portfolio in a way that gives us more comfort in regards to guiding us regarding our monthly budget during times of high volatility, which is quite common for bitcoin historically and likely to be inevitable in bitcoin's future, in spite of people ongoingly wanting to suggest hat bitcoin is becoming a mature asset.. which relatively speaking I have my doubts about its volatility and/or battles going away in the coming 10-15 years or more.

But that would depend on many things like your current income and what percentage of it you would like to spend.

But that would depend on many things like your current income and what percentage of it you would like to spend.