1. We will see a drop in the hash rate once the halving occurs due to mining being unprofitable for inefficient miners, this will lead to longer block times until the difficulty is adjusted 4 days later. Longer block times means people paying higher fees to get into the next block.

Bitcointalksearch.org - what's this site?

It was the Bitcointalk forum that inspired us to create Bitcointalksearch.org - Bitcointalk is an excellent site that should be the default page for anybody dealing in cryptocurrency, since it is a virtual gold-mine of data. However, our experience and user feedback led us create our site; Bitcointalk's search is slow, and difficult to get the results you need, because you need to log in first to find anything useful - furthermore, there are rate limiters for their search functionality.

The aim of our project is to create a faster website that yields more results and faster without having to create an account and eliminate the need to log in - your personal data, therefore, will never be in jeopardy since we are not asking for any of your data and you don't need to provide them to use our site with all of its capabilities.

We created this website with the sole purpose of users being able to search quickly and efficiently in the field of cryptocurrency so they will have access to the latest and most accurate information and thereby assisting the crypto-community at large.

Topic: [Aug 2022] Mempool empty! Use this opportunity to Consolidate your small inputs! (Read 82841 times)

1. We will see a drop in the hash rate once the halving occurs due to mining being unprofitable for inefficient miners, this will lead to longer block times until the difficulty is adjusted 4 days later. Longer block times means people paying higher fees to get into the next block.

Why?

First, the difficulty has nothing to do with the amount of spam those guys throw at the chain.

If you think that there will be a massive block slowdown that won't happen in 5 days either, because 2/3 of the period has passed, so even if we are going to see something like 20% down instantly it will only last 6 days out of which 4 are doing the weekend.

Costly, a big clog, maybe, but in no way brutal.

Plus I'm not even convinced about that 20%, we just had 4% up previously, and even right now we're 2% in the green with faster blocks, as I said in the speculation topic, my bet is on at max 10% during the first adjustment.

My logic is that

1. We will see a drop in the hash rate once the halving occurs due to mining being unprofitable for inefficient miners, this will lead to longer block times until the difficulty is adjusted 4 days later. Longer block times means people paying higher fees to get into the next block.

2. At the same time, Runes come into play, also driving up the fees.

3. We are already in a high fee environment, this is just adding to it.

"Brutal" is a subjective term, I just see things getting even worse for a while due to the above.

I haven't been around long enough to understand the nuances of what will drive the difficulty up or down, but if BTC stays above $60k I agree that the difficulty drop won't be drastic.

Why?

First, the difficulty has nothing to do with the amount of spam those guys throw at the chain.

If you think that there will be a massive block slowdown that won't happen in 5 days either, because 2/3 of the period has passed, so even if we are going to see something like 20% down instantly it will only last 6 days out of which 4 are doing the weekend.

Costly, a big clog, maybe, but in no way brutal.

Plus I'm not even convinced about that 20%, we just had 4% up previously, and even right now we're 2% in the green with faster blocks, as I said in the speculation topic, my bet is on at max 10% during the first adjustment.

Did the same, 14 out of 15 were funded 2 days prior and the only activity on those addresses was one funding tx.

So maybe a casino/cex/something collecting user deposits?

The days after the halving tomorrow and before the difficulty adjustment in about 5 days will be brutal for fees with the Runes added in. It will likely take some weeks after the difficulty adjustment for fees to settle out to a new normal.

To be honest, it makes me curious, why people pay so much fees to create ordinals inscriptions. Are thousands of ordinals sold each day? And are they sold so expensively that it worth to pay hundreds and thousands in transaction fees? I have seen ordinals pay x100 and more than its recommended to pay to get transaction confirmed.

Maybe there is a secret sauce that we miss here.

However, in this case, I checked some of the inputs, and all of them were funded earlier this month. It makes me curious why someone would waste so much money this way.

Financial reasons perhaps (ironically), as infrastructure for creating Segwit wallets and transactions is still severely lacking even in 2024 and most companies can't be arsed to hire more engineers to update their systems.

It's one of the things that ZPyWallet tries to solve, but admittedly it's going to take much more than a Python library to create a framework where people can easily use Segwit addresses.

Indeed, doesn't look very economical to me either. As far as I glimpsed over the transaction, that were 217 legacy address inputs. Why still legacy address use? Anyway, not my cup of tea and the transaction sender might have a reason to shovel an absurd proportion of the transacted amount as fees to miners. At least the fee rate is declared as optimal at the time the transaction was confirmed.

We don't know the purpose of this transaction and I would've done a lot different already upfront. Everyone has the freedom to turn his coins into transaction fees. Is it wise? I don't think so.

Actually even funnier, they aren't even collecting their own inputs via their pool, they have like 50 unconfirmed consolidations sitting there for months.

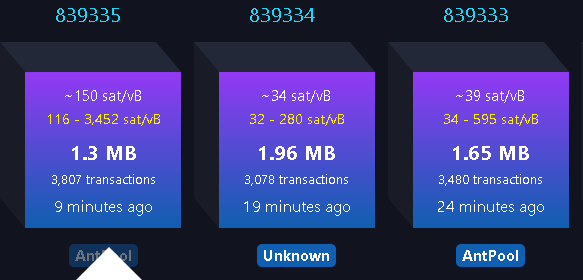

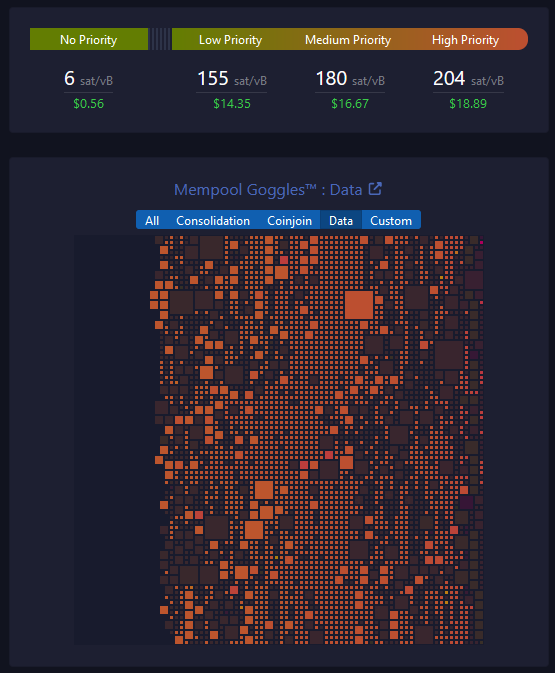

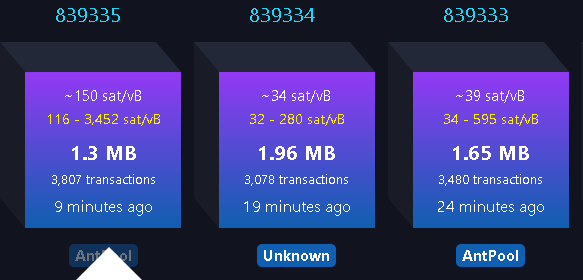

The amount of fees that people are willing to pay just to insert random images into the blockchain amazes me. 204 sat/vB is just an obscenity.

Binance isn't forcing its transactions through their pool, for example this was just confined by antpool:

https://mempool.space/tx/44043a606a2d0c8c9513d750bf628bc2b2e17d4b91e39a107c78334d796bcff5

they just paid 148sat/vb, it says optimal but optimal my ass it's all because they've dumped themselves half a block of tx at over 100sat/vb

Actually even funnier, they aren't even collecting their own inputs via their pool, they have like 50 unconfirmed consolidations sitting there for months.

And now to make Switzerland's blood boil again, I present you:

https://mempool.space/block/00000000000000000000581af7f866e530053928e8b0e7c3dfe899923d64a9fc

My bet would be on those services that offer inscription and minting for a fee, you just upload a jpg and they give you a quota on what it will cost you.

Transaction: https://mempool.space/tx/9b603cd261483db175f60cdf31f5623300ed5036276919c7331e2a398d8d6fce

So in the end, it takes little effort to clog the network, cause...you know...1MB is enough for everyone

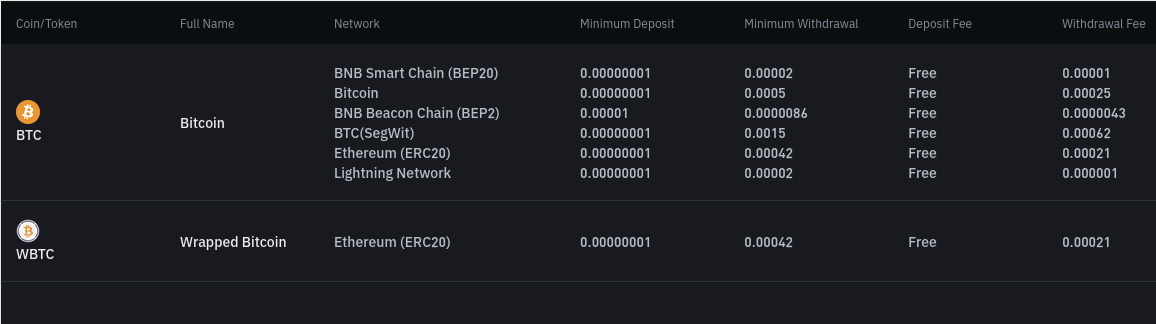

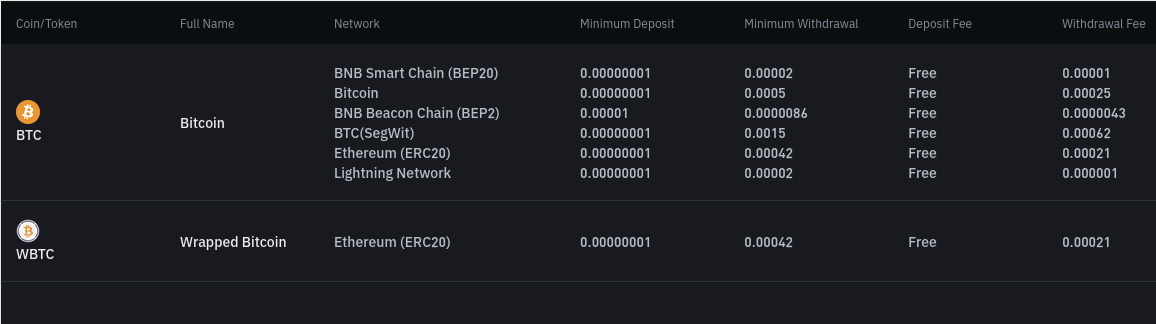

By the way, I just checked Binance's Bitcoin withdrawal fees and I am kinda confused. Withdrawal fee for Bitcoin (legacy) is 0.00025 BTC while the withdrawal fee for SegWit that's supposed to be nearly 40% lower, is 0.00062 BTC. Did I misunderstood something here or doesn't this make any sense?

No. After reading the part I'll quote below (and I'll make some text bold to stand out), I think the correct approach (or at least one step in that direction) would be to make the P2TR output size be counted and limited to a reasonably small size.

The small detail about P2TR output size tells that Ordinals actually exploit a missing rule in Bitcoin.

Of course, we should also keep an eye on who is also spamming the blockchain. Maybe some service actively tracking and sorting all possible spam sources could get a good feedback from the community. (Yes, I know, it's easy to say/dream...)

Maybe it's time to significantly raise the dust limit. This transaction creates more than 1000 dust inputs.

Or maybe several people use same script/software which create TX with static or poor fee rate choice algorithm.

I recall the dust limit was lowered from about 5460 satoshi to 546 satoshi some years ago, partially due to rising Bitcoin price. Unless Bitcoin price decline significantly, i don't expect dust limit will be raised.

Maybe it's time to significantly raise the dust limit. This transaction creates more than 1000 dust inputs.

https://magiceden.io/ordinals/discover-raresats?walletAddress=bc1pj54z06qh9pxhae09xw3mvrupzfppfgstfxvuhtt52t4fpgrvhs2qkmzqct

strange, he even overpaid fees.

It's minting brc-20 tokens

https://ordiscan.com/address/bc1pj54z06qh9pxhae09xw3mvrupzfppfgstfxvuhtt52t4fpgrvhs2qkmzqct

and it's related to these

https://ordiscan.com/address/bc1pvu6qnzpuyl6w3vmpuy79d6slplr7fyhan9wd476npjnf070wgn9s3uyjr2

Normally I wouldn't mention them since, well, just some addresses with inscriptions, there are thousands, but speaking of weird transactions, this one really made me curious, I mean, what the f is it actually doing?

https://mempool.space/tx/634a89b727cda93ddd10ea68dc08e7f17163444ee018881b4bf3fa98900bca02

Just how his pool filters them but, money is what it counts, so 6 months and it's still just getting one exahash per day.

https://ocean.xyz/dashboard

As I said, I don't know "all the data", is it indeed only one entity doing all the spam?!

But at the end, it goes to miners (and, as you said, let's not count on them because they're in only for the money) and maybe to community too.

I guess that the community can do wonders - from switching to a "filter on" wallet/node to actually putting pressure/convince the devs to this direction. But... is the community convinced? Imho it's not. Imho if we want to go on this direction we may need to start with properly exposing the wallets (and hopefully entities too) that are responsible for all this spammy mess.

It feels soooo like in the winter of 2017/2018...

So it's not Ordinals related after all? Interesting...