Don't forget that gold is older than BTC and before the BTC will be coming close to such years, BTC will be more popular than gold which we can see the results in different countries that adopted BTC to enable their youths to have potential skills that will improve their progress in the country.

I have never tested gold investment and, I will never invest my money on gold because BTC investment is still more profitable than gold and I will continue to make BTC my choice because I have the skills.

They are different products and I don't see the reason people always like comparing the two because gold is older than bitcoin and have been used for transaction even before bitcoin was invested so they see the reason why they should compare the two and if you want to even compare what investment people will choose when it comes to trust people will definitely go for gold because they believe so much in gold just because gold have exited for long and it is usually a bar if not for the invention of the digital gold. and young people have chosen their own part which is bitcoin and just the way gold is accepted everywhere the same way that bitcoin is also accepted everywhere. they have similarities. I know majority of young people don't have business with gold and I am very sure that older people still prefer to invest in gold than in bitcoin all is because of the understanding they have.

People like to compare bitcoin and gold because bitcoin was largely designed around several of the premises of gold as sound money, yet bitcoin was designed in such a way to be even more sound money than gold with storage of value and peer to peer transaction, and bitcoin has both. Surely, also bitcoin does not have the same kinds of third-party costs and obstacles as gold, and the fact of the matter is that many of us have likely come to understand that bitcoin is not only better than gold in a lot of aspects, and that bitcoin is likely in the ballpark of 1,000x or more better than gold in terms of various aspects of bitcoin's monetary qualities, so not only the scarcity of bitcoin, but also the verifiability, transportability, divisibility and the lack of dependency on third parties that end involving extra costs and even security issues.

Surely there are aspects of financial sovereignty that can take place when there is authority over one's own money and value, and gold is not completely lacking in such qualities, since both gold and bitcoin are bearer instruments, but there still can be questions in regards to with whom any of us might be able to transact.

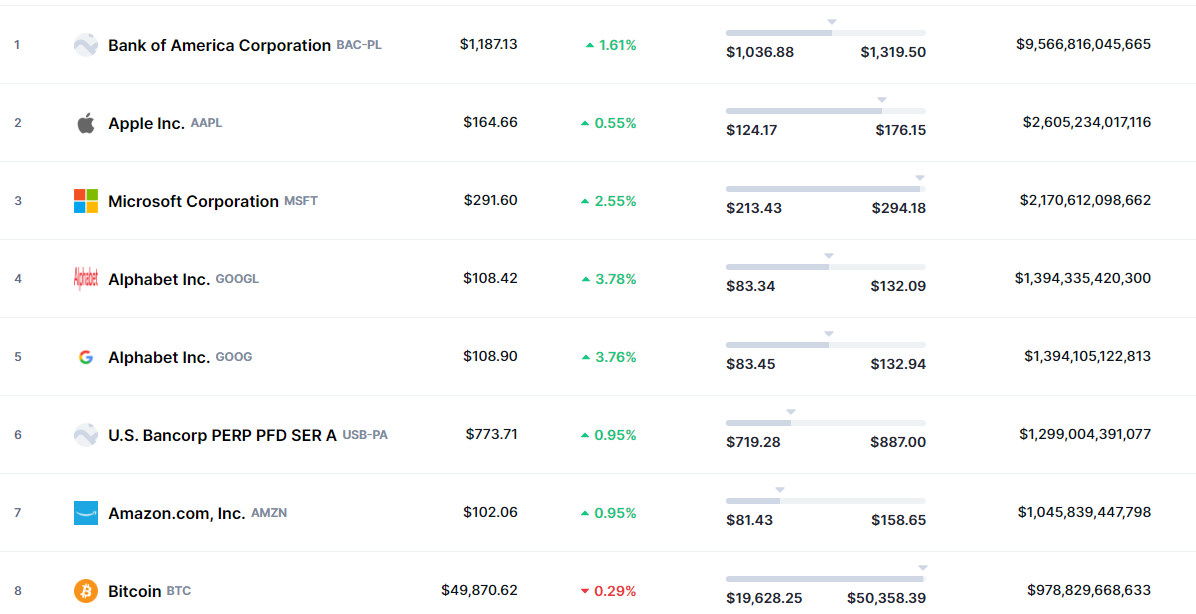

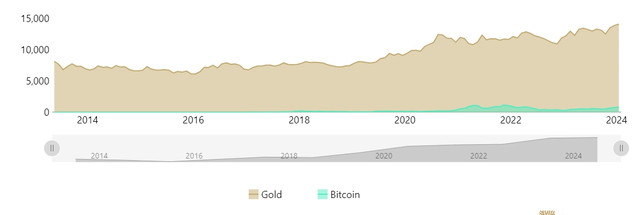

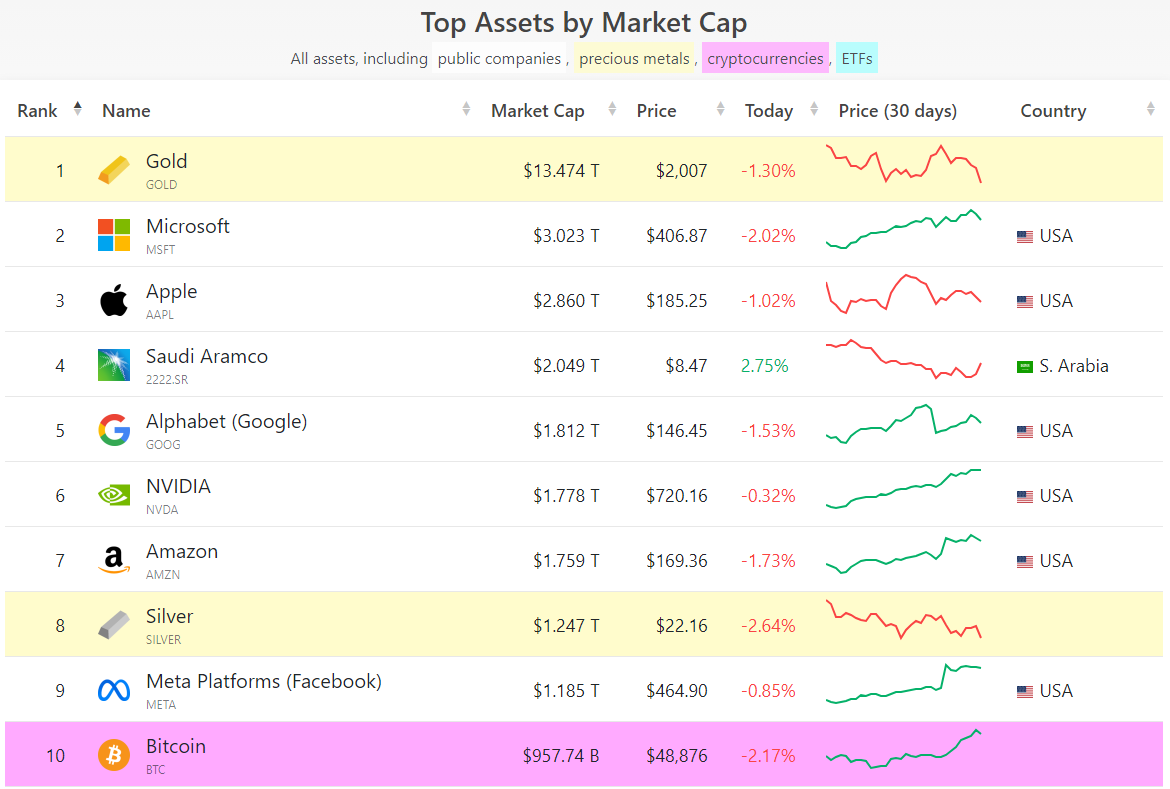

Currently, in terms of price, bitcoin is about 1/10th the market cap of gold, and so if it were to get to 1,000x gold's market cap, then that is about a 10,000x price adjustment with either bitcoin going up or gold coming down or both... and so getting to gold's parity in market cap could happen this cycle or it may take a bit of time, such as even another cycle or two (yet I have my doubts it would take a couple of cycles to reach mere parity with gold), and as others have said one thing is to reach bitcoin/gold parity, yet another thing is to sustain such parity... and then maybe getting to 10x higher than gold might not even be that difficult as compared with bitcoin potentially becoming way less volatile (relatively speaking) as compared to today when in the future bitcoin might be bouncing around and going from 10x of gold's market cap to 1,000x gold's market cap, which also could take 50-200 years to achieve.

There are likely going to continue to be battles along the way, since status quo rich probably do not appreciate their value being transferred into bitcoin, which has been happening in the past 10 years and is likely going to continue to happen at a considerably increasing rate.. the transfer of wealth from the no coiners to the coiners, and even ongoing and various confusions along the way in regards to figuring out what asset(s)/ currencies are more valuable, while at the same time people are figuring it out and are going to continue to figure out that bitcoin is the place to keep their value or to gravitate their own value into bitcoin in line with Gresham's law kinds of principles, even if most normies have no clue about what is Gresham's law, they still likely realize to spend their less valuable assets/currencies first.

Eith time it is quite likely that the value of gold and other monetized assets are going to flow (get sucked) into bitcoin, and right now the world has close to 1 quadrillion of monetized assets/currencies/commodities,

** and surely bitcoin would then have a current addressable market that is close to 1 quadrillion, since bitcoin is likely the most efficient, the best and the most sound of the monetary assets, so value is going to continue to flow into bitcoin, even though it could take 50-200 years for the fuller sense of monetization to flow into bitcoin.

If we are referring to gradually and then suddenly, surely it can take some time for adoption and growth to continue to build and it might not even be very noticeable when the growth of bitcoin is going from its current state of less than 1% of the monetized world assets and then it gets to higher and higher levels of monetization.. since bitcoin is the most efficient and the strongest of the monetized assets/currencies, so people are going to realize that it is better to put value into bitcoin rather than other places that they had been keeping their value.

Bitcoin is not only gold 2.0.. but it is gold at about a 1,000x multiple.. people are catching on. and anyone still deluded into believing that bitcoin and gold are different or that they each have their own space or that there is some kind of a need to keep both, then sure they can have fun staying poor...It is not like I am wishing these kinds of conditions rather than just describing where the world is going in terms of bitcoin ongoingly eating gold's lunch and going to continue to eat gold's lunch, including eating the lunch of the various (multiple) other less efficient storage of value assets and monies. If you are merely thinking about bitcoin/gold parity, then you are surely thinking small potatoes and don't even realize what bitcoin is...which is fine.. just go study it a bit more.. or buy/stack some in case it catches on.

**In 2021, Jesse Meyers had proclaimed that the total addressable market was $900 trillion, but I think that $1 quadrillion is easier to work with as a nice round number. Here is a quote from a November 2021 Bitcoin magazine article and it has Luke Mikic's name, even though I think that the purported moon math comes from Jesse Meyers.. here it is:

>>>>"Moon Math: Bitcoin’s Total Addressable Market?

Let’s analyse just how easy it would be to send bitcoin on a meteoric rise that breaks all models. First, let’s ask ourselves: What is Bitcoin’s total addressable market (TAM)?

$12 trillion gold market

$250 trillion real estate market

$300 trillion global debt

$90 trillion global equity market

$100 trillion fiat

$100 trillion bond market ($18 trillion being negative yielding)

$1 quadrillion derivatives market

There's currently $900 trillion of total money and debt in the world when you ignore the derivatives market. Let’s move forward on the assumption that BTC is the next evolution of money and acts as a black hole that'll suck in all value (which it will), if we move onto a BTC standard."<<<<<<<