If you follow this topic from start you will see that situation changed a lot, and having more than 51% of hashrate was always problematic.

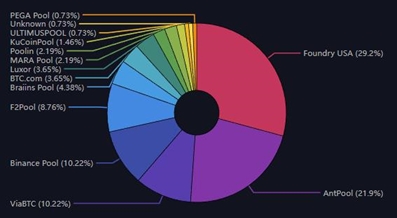

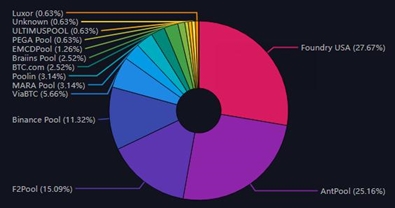

Before the China ban it was Bitmain with their pools (Antpool, BTC.com and Viabtc) arguably even Poolin which was founded by an ex-Bitmain employee before the 2020 lawsuit, and then, on the other side, you had F2pool, those pools combined always had well over 50% of the total hashrate, and don't be fooled by all the names, essentially, 2-4 Chinese men sitting in closed room had the final say on what to do with all that hashrate.

Fast forward, China banned mining, and U.S players started to get into the business, creating their own mining pools, and now it's no more 2-3 Chinese men, it's 1-2 Chinese and 1-2 Americas, still the same number of entities who control well over 50% of the total hashrate, and since

BTC doesn't care about those folk's nationality or names, nothing has changed in terms of hashrate distribution.

I have been professionally mining

BTC long before this topic took place, and I have been following hashrate distribution years before Foundry USA pool came into existence and the fact that 2-3 entities owning over 50% of the hashrate have been the case since at least 2016, it's a lot more than just looking at a pie chart and thinking you solved the puzzle, you need to understand how are all these pools are connected, then use that knowledge to compare hashrate distribution for the past decade, and you will come to the same conclusion.

Furthermore, pool distribution is pretty irrelevant compared to gear ownership and the physical location of that hash power, at least 80% of the hashrate comes from a single manufacturer, that's more to worry about than some random pool distribution which can change drastically over the course of a few hours, the physical location of the gears and the law which they operate under is also a serious matter.

I'd rather see 3 large pools each owning 33% but hashrate divided between 50 different countries where no country has over 10% of it, rather than seeing 100 pools, each with 1% hashrate but 70% of that hashrate located in the same countries with the same laws and regulation, even worse, that majority of that 70% is owned by a single entity.