Bitcointalksearch.org - what's this site?

It was the Bitcointalk forum that inspired us to create Bitcointalksearch.org - Bitcointalk is an excellent site that should be the default page for anybody dealing in cryptocurrency, since it is a virtual gold-mine of data. However, our experience and user feedback led us create our site; Bitcointalk's search is slow, and difficult to get the results you need, because you need to log in first to find anything useful - furthermore, there are rate limiters for their search functionality.

The aim of our project is to create a faster website that yields more results and faster without having to create an account and eliminate the need to log in - your personal data, therefore, will never be in jeopardy since we are not asking for any of your data and you don't need to provide them to use our site with all of its capabilities.

We created this website with the sole purpose of users being able to search quickly and efficiently in the field of cryptocurrency so they will have access to the latest and most accurate information and thereby assisting the crypto-community at large.

Topic: Everything you wanted to know about Grayscale BTC Trust but were afraid to ask! (Read 16372 times)

The SEC filing also showed they seeded the funds with 63,204 Bitcoin.

This was is a huge amount, almost 10% of total funds. So I think they are going to “airdrop” this to their current customers.

Of course, this will act as a de facto fee reduction of almost 9%, as, of course, this switch event won’t be taxable.

So I guess the outflows from GBTC will go on in the future, but at least there will be a lesser outflow from broad Grayscale products.

Now that presumedly Genesis has finished selling, I can't see why anyone else should do so: New buyers are focusing on IBIT and FBTC, instead of the legacy fund. We might be near the bottom in GBTC.

just witnessed? its the weekend, buys(to dissolve shares and outflow coin holdings) die down at weekends

..also it was US spring break and about to be other countries easter break.. so expect slowdown. even traders need a holiday

also GBTC buyers(to then request dissolving shares to move coin out to exchanges(outflows) to then move into other etf(inflows)) are not done by end user investor buyers of shares (meaning not done by your grandparents, your parents, your pension)

its actual 100% AP(brokers(agents/sponsors)).. emphasis, not your grandparents.. not end investors

Nice analysis, but I guess all the GBTC recent selling was about Genesys selling shares and using proceeds to buy BTC (sort of neutral market move).

The thing is that buying from IBIT and FBTC also slow down.

Wondering what is driving what. GBTC driving inflows or the other way around?

Now that presumedly Genesis has finished selling, I can't see why anyone else should do so: New buyers are focusing on IBIT and FBTC, instead of the legacy fund. We might be near the bottom in GBTC.

just witnessed? its the weekend, buys(to dissolve shares and outflow coin holdings) die down at weekends

..also it was US spring break and about to be other countries easter break.. so expect slowdown. even traders need a holiday

also GBTC buyers(to then request dissolving shares to move coin out to exchanges(outflows) to then move into other etf(inflows)) are not done by end user investor buyers of shares (meaning not done by your grandparents, your parents, your pension)

its actual 100% AP(brokers(agents/sponsors)).. emphasis, not your grandparents.. not end investors

Now that presumedly Genesis has finished selling, I can't see why anyone else should do so: New buyers are focusing on IBIT and FBTC, instead of the legacy fund. We might be near the bottom in GBTC.

@franky1. Does that imply Grayscale will never lower their management fees? They would not have announced to lower it if they did not want it, I reckon.

i reckon they will either:

get down to a safe hoard amount of GBTC(still have some grayscale owned coin locked) before lowering fee's of gbtc)

or

more savvi just get a 'mini' approved(if approved that is) and just empty GBTC and get brokers to basket up coin in the mini and let the GBTC die out

but their main game is to have high fee's to not have brokers in GBTC adding baskets(coin/shares).. because they want AP's trying to get current grayscale owned basket shares dissolved and converted into btc to sell off so grayscale can de-risk themselves of having a huge coin hoard in ownership

Recent weeks, I saw many posts on X platform with Ethereum Gas Fee Refund. Misleading scam posts like "I receive $x,xxx of gas fee refund from Ethereum" is very annoying.

I reported many posts in X Ads but X platform and their staffs didn't do anything to stop those scam Ads.

@franky1. Does that imply Grayscale will never lower their management fees? They would not have announced to lower it if they did not want it, I reckon.

grayscale then want to make a secondary ETF where they dont "own" the baskets, but instead just manage other brokers baskets

https://www.grayscale.com/blog/general-updates/what-is-grayscale-bitcoin-mini-trust

they want brokers to buy grayscale(dcg) owned coin of what was 630k in december 2023.. and move it out of grayscale gbtc ownership, and into other etf(eventually hope of grayscales non-self-coin owned etf offering of the 'mini'

and then the brokers own the coin and lock it into coinbase for coinbase(dcg sister) to manage and grayscale(dcg sister) to manage, without ownership by any DCG sister

The market where Grayscale did not have big competitors against their investment products has clearly ended.

Grayscale CEO Michael Sonnenshein said the company expects to reduce fees on its GBTC Bitcoin ETF in the months ahead. The move likely comes as GBTC continues to witness outflows while other competitors such as BlackRock and Fidelity grab massive market share from Grayscale.

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that fees tend to be higher during the initial stages and gradually come down as the market matures and demand for the products rises.

Source https://coingape.com/gbtc-bitcoin-etf-fees-to-drop-soon-says-grayscale-ceo/

Gas fees is a shitcoin term and fuck shitcoins.

Yeah, GBTC is not bitcoin, but still "gas fees" is not an appropriate term.

It is management fees, and they are likely realizing that their high management fees inspires some resentment that contributes towards the flight of so many of their coins.

The market where Grayscale did not have big competitors against their investment products has clearly ended.

Grayscale CEO Michael Sonnenshein said the company expects to reduce fees on its GBTC Bitcoin ETF in the months ahead. The move likely comes as GBTC continues to witness outflows while other competitors such as BlackRock and Fidelity grab massive market share from Grayscale.

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that fees tend to be higher during the initial stages and gradually come down as the market matures and demand for the products rises.

Source https://coingape.com/gbtc-bitcoin-etf-fees-to-drop-soon-says-grayscale-ceo/

If Grayscale had any intentions of reducing those gas fees they are more than capable of doing them now so why wait till market gets matured while their competitors are very ready to take advantage of any mistake they make and if Im right then gas fees is what anyone would consider when investing in Grayscale GBTC or maybe since he intends to reduce gas fees later what is the plan or reason behind the high gas fees now ?

The market where Grayscale did not have big competitors against their investment products has clearly ended.

Grayscale CEO Michael Sonnenshein said the company expects to reduce fees on its GBTC Bitcoin ETF in the months ahead. The move likely comes as GBTC continues to witness outflows while other competitors such as BlackRock and Fidelity grab massive market share from Grayscale.

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that fees tend to be higher during the initial stages and gradually come down as the market matures and demand for the products rises.

Source https://coingape.com/gbtc-bitcoin-etf-fees-to-drop-soon-says-grayscale-ceo/

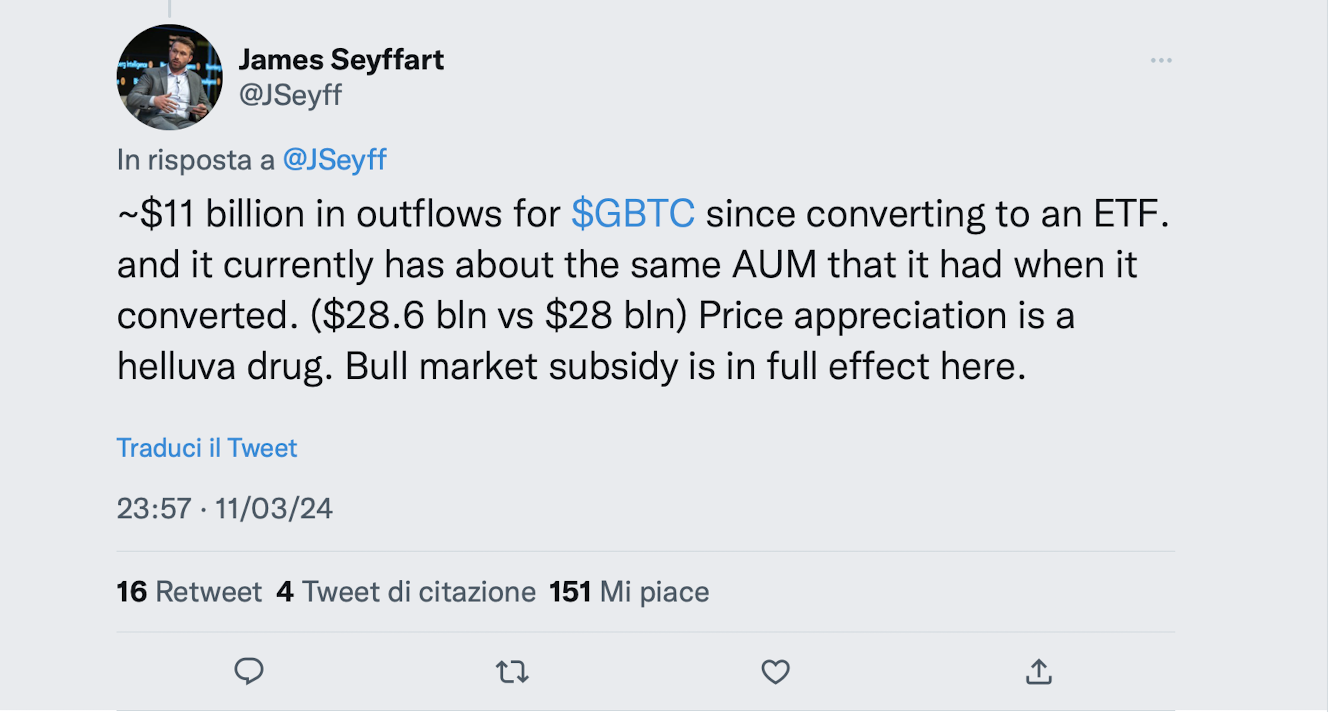

Of course, if you have outflows but the Bitcoin price keeps growing, in the end, your asset under management won't decrease, as the effect on price would offset that from the outflows.

Corollary: if the price increases, it would offset also the decrease in fees. Hence, Grayscale has little incentive to lower it.

Spreads to NAV are closing, liquidity is improving and spreads from market makers are becoming tighter.

All this highlights the situation normalising around GBTC, and they are becoming less relevant as we go on.

This is true until Genesis decides to dump their bag, of course.

In any case, Grayscale sent 4018 bitcoins to Coinbase according to some news articles. This might be the cause of the latest dump or this dump presently might only be the fear of the real dump.

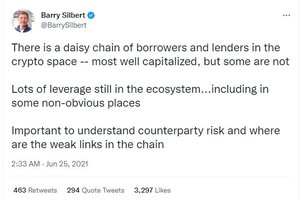

the FTX related stuff was the "contagion"

this new buzzword "daisy-chain" appears to be another ordeal which silbert feels needs a new name

i guess its because its due to his company having so many sister companies playing in his backyard that the effects of one affect another and another and it comes round full circle like a necklace(daisy chain)

(satire analogy)

i can imagine silbert one day imagined his companies as daisys and imagined SEC gensler as the bully/crush.. so plucking at each daisy in his chain.. "he loves me, he loves me not, he loves me, he loves me not" when evaluating business risk of each company in DCG portfolio

as for grayscale. they are not sending coin to coinbase. they are releasing coin from coinbase.. literally every day

that said. last reports were of a 3394minus outflow

and 4018 is not much when talking about the scales they have. and the debts DCG have

~$200m (4018 at $50k) vs dcg $3b

4000btc is not even a quarter of their fee's for 2023 (grayscale earned like 16k coins in just fee's in 2023)

also worth noting. a $52k-$51k (2% change) is not a "dump", thats just daily opportunity

In any case, Grayscale sent 4018 bitcoins to Coinbase according to some news articles. This might be the cause of the latest dump or this dump presently might only be the fear of the real dump.

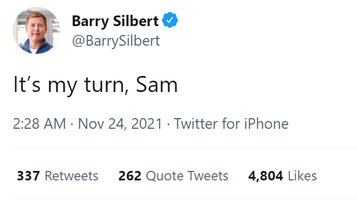

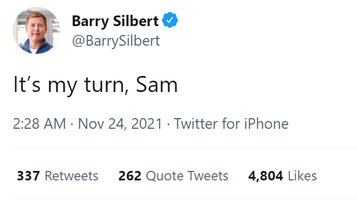

Also, what was he implying when he tweeted to Sam Bankman Fried that it is his turn hehehee.

both in criminal trouble

no surprise, with multiple cases involving DCG and its many sister companies.

before FTX got infamous DCG even had FTX listed on DCG portfolio.. so DCG invested directly with FTX

(from memory: i think it was about $250k direct equity investment of FTX in july 2021 + then offered $xxxm of loaned/collateral within FTX)

as for "daisy chain"... i guess the "contagion" is no longer trendy

, a windfall for the bankrupt cryptocurrency lender’s creditors.

Crypto exchange Gemini Trust in October sued Genesis, its former business partner, over the shares, saying they were pledged as collateral on loans to Genesis from customers in Gemini’s Earn investment program. The shares are now worth more than $1.2 billion as the price of bitcoin, the fund’s underlying asset, has more than doubled since Genesis filed for bankruptcy.

so dcg/genesis lost $1.2b in january due to the genesis ftx fiasco. and now gained $1.2b in the genesis earn fiasco

but now owes an extra $2b (was 1 then $3b as reported by attourney general) in the genesis/gemini fiasco

31.2m shares at @0.00089309btc= 27,864btc now back in the control of DCG(via genesis sister), lets see how fast they dissolve the shares and cash out the coin.. after all genesis is in bankruptcy administration so cant hoard it and continue business

(sidenote. DCG had 36m shares(declared) pre ETF launch which sold off to pay FTX now they have sister company genesis with 31.2m shares(officially declared last week))

all its doing is basically saying DCG will have to pay back $3b instead of $1b. so we will just see grayscale get rid of another $2b of assets (40,000btc)